If you’re an American living abroad, your tax obligations are a little bit more complicated than most other nationalities.

You may assume that if you’re not earning money in the United States, you have no obligation to file a tax return each year. Unfortunately, this couldn’t be further from the truth.

Depending on your filing status, the income threshold in 2018 is somewhere between $400 and $23,200. More information on minimum income requirements is available in the TFX US Expat Tax Guide for 2018.

Most multinational firms that send their employees abroad will make them aware of the US tax implications of foreign-earned income. The folks who may get caught by surprise are often:

- Self-employed workers or contractors,

- Digital nomads,

- Retirees,

- Missionaries,

- Expats who work for small- or medium-sized companies that don’t have the necessary experience, and also

- Green card holders.

Luckily, Taxes for Expats can help get you sorted. The service will do all the hard work for you so you can make sure you meet all your tax obligations and don’t end up with a hefty bill (or fines).

Taxes for Expats (TFX) is a tax firm that has been involved in expat tax preparation for over 25 years. Their goal is it to make the filing process as easy and painless as possible.

The Human Factor

At TFX you work directly with seasoned professionals who have at least ten years of experience in the industry. In fact, many of TFX tax experts have 20 years or more of experience under their belt. It’s also worth noting that TFX doesn’t outsource their resources. Instead, all of their employees are US citizens.

If you have a question or concern, you can reach TFX via chat or call 18 hours a day. That means, regardless of where in the world you live, you’ll always be able to get your tax questions answered quickly.

Fair and transparent pricing

The advantage of working with a tax firm, such as TFX that has filed ten-thousands of tax returns for expats is that they know what’s involved. As a result, TFX offers fair and transparent fees and pricing. For example, for a single year tax return TFX charges between $350 and $450, depending on if you earn more or less than $100k.

That’s pretty much what I pay for my domestic return, which is much less involved than what a person living abroad may deal with.

The TFX System

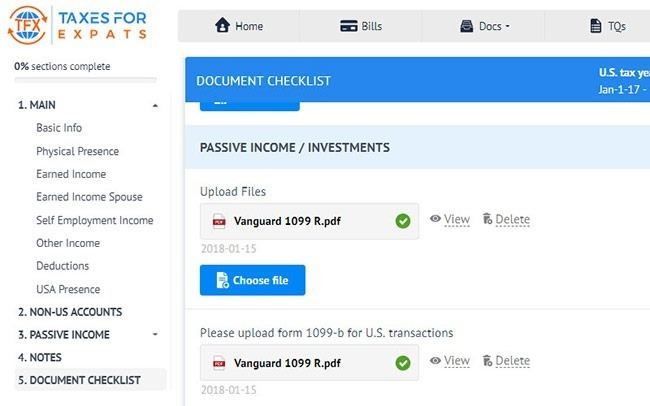

Taxes for Expats – Online Tax Questionnaire

To make working with TFX as simple as possible, TFX has invested a significant amount of resources in their secure online portal. As a result, you won’t have to mess around with uploading Excel spreadsheets or PDF files. Instead, TFX leverages a responsive web-based tax questionnaire to collect all the required information from you. It’s smart too – for example, if you have to file for multiple years, it automatically copies the relevant information over, so you don’t have to type it again.

Of course, TFX encrypts all of your sensitive information using AES-256, which is the de-facto standard and used by financial institutions worldwide.

A question of trust

Picking a CPA or tax firm to assist with your tax return is a delicate matter, and often you may want to meet the person face-to-face who you plan on handing over your financial information to.

Unfortunately, if you live abroad, that may not be an option, and so you have to rely on reviews and testimonials.

TFX has over 20,000 customers, and their clients work for more than 1,000 organizations in over 190 countries, including Microsoft, Google, and IBM. What I liked most about their “social proof” strategy is the video testimonials from expats all over the world. To me, a video testimonial often requires a more significant commitment from the customer than a few lines of text. And a customer who wasn’t truly happy with the product or service provides would likely not submit one. You can learn more about what others have to say about TFX here.

WHY SHOULD YOU FILE TAXES FOR INCOME EARNED ABROAD?

The simple answer is because it’s the law and the US government may penalize you if you don’t. For a complete list of reasons and various “what-if” scenarios, check out this page.

HOW TO GET STARTED WITH TFX

Taxes for Expats – Getting Started

If you earn foreign income and you decided you would like to solicit help with the filing process, getting started with TFX is incredibly easy:

- Register for an account, which takes about 30 seconds.

- Schedule a 30-minute intro call so TFX can learn more about your particular case. You will have to pay a $50 retainer fee at this point that goes towards your tax return.

- Complete the tax questionnaire using your web browser.

- Sign an electronic engagement letter that explains precisely what services TFX is going to provide and what the fees are.

- Let TFX prepare your tax return, which usually takes up to fifteen business days after you have signed the engagement letter.

- Review your tax return, pay and, if applicable, let TFX e-file it for you.

In my opinion, it doesn’t get much more comfortable than that. In fact, it sounds much easier than the process I have to go through every year, including exchanging PDF documents and Excel spreadsheets with my CPA.

CONCLUSION

If you are still on the fence, whether or not to engage TFX, I would highly recommend reading through their FAQs and tax guides. If nothing else, you’ll learn a lot. I know that I have learned more about taxes, tax laws and the filing process for expats than I thought I ever would.

A Food Fun Travel Guest Post